CVI Portfolio

Washington, DC Metro

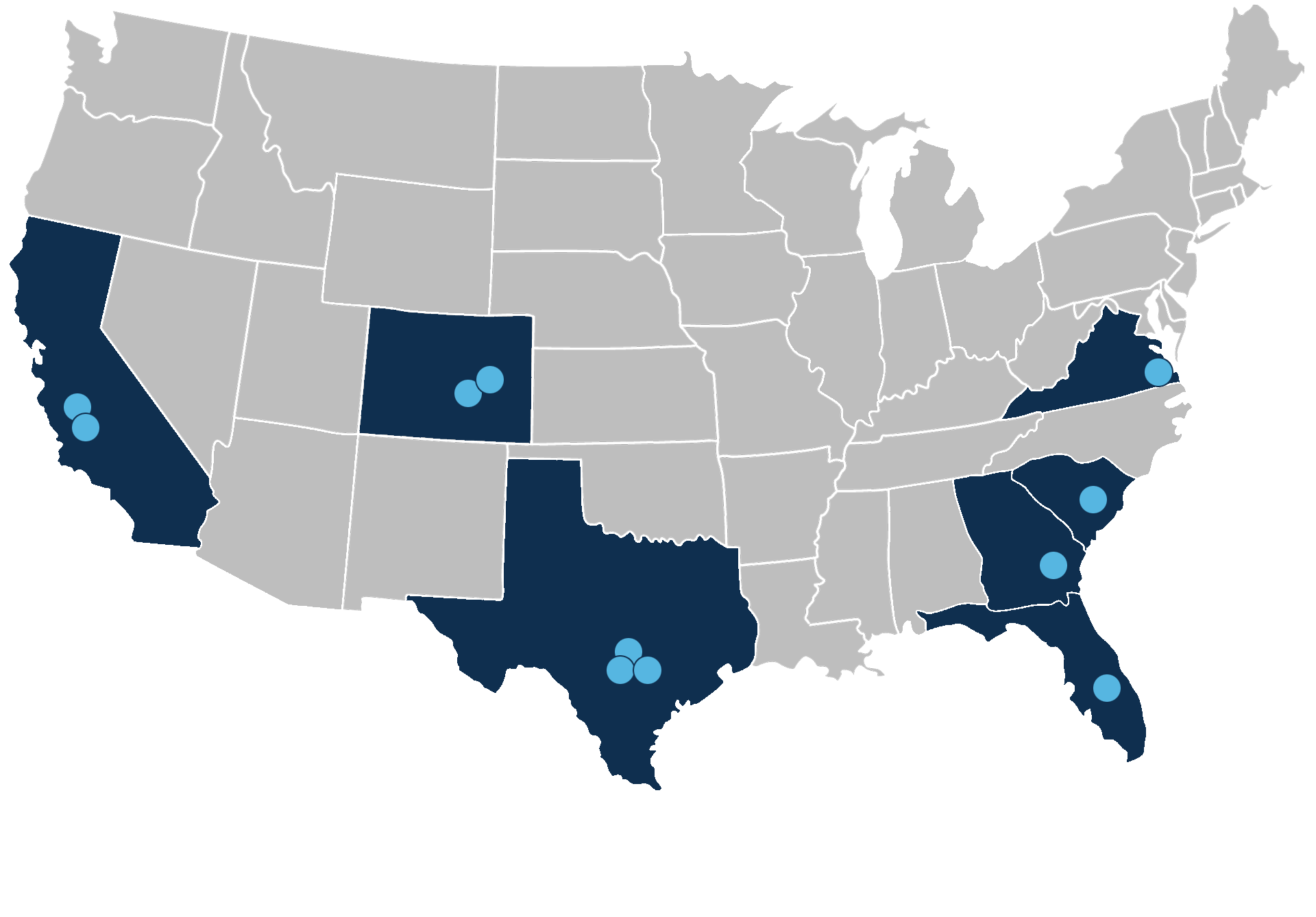

In August of 2012, FVP, in a partnership with the Lynd Companies, purchased the CVI multifamily portfolio. The 11 asset portfolio was foreclosed upon and the Special Servicer was directly selling the distressed group of assets. The portfolio included assets in several expanding markets such as Denver and Austin. FVP identified deferred maintenance, mismanged and a degree of neglect from the previous owner which providing the opportunity to execute a property renovation and value-add scopes to stabilize the assets and enhance the value of the properties. The portfolio was acquired at a point in the real estate cycle when the distressed nature of the portfolio created a low-basis entry point for the joint venture at a time when demand for rentals was high and the anticipated rent growth was very strong. The transaction highlights FVP’s ability to work alongside its operating partners to close a multi-state, large-scale portfolio and to manage the renovation and stabilization of the overall portfolio.

PROPERTY INFORMATION

Location 7- State Portfolio

Address 5802 Annapolis Rd

Property Type Garden Style

Description Suburban Multifamily

Property Size 3,240 units Portfolio

Acquisition Date Aug-12

Investment Strategy Opportunisitc / Value-Add

Total Capitalization $145,000,000

Total Eqiuty ~$54m

Disposition Date 2016

Disposition Value $236,000,000