CASE STUDIES

PROPERTIES

Explore our portfolio of properties across the country

Alternative Asset, Education Properties

Student Housing

Property Class: A

Description: Value-Add

Size: 98 Units / 380 Beds

Acquisition Date: Aug 22, 2023

Total Cap: 32,000,000

Bellamy Apartments

Daytona, FL

Alternative Asset

Self Storage

Property Class: A

Description: New Construction

Size: 98,000 SF

Acquisition Date: Aug 1, 2023

Total Cap: 14,500,000

ValueStoreIt24

West Palm Beach, FL

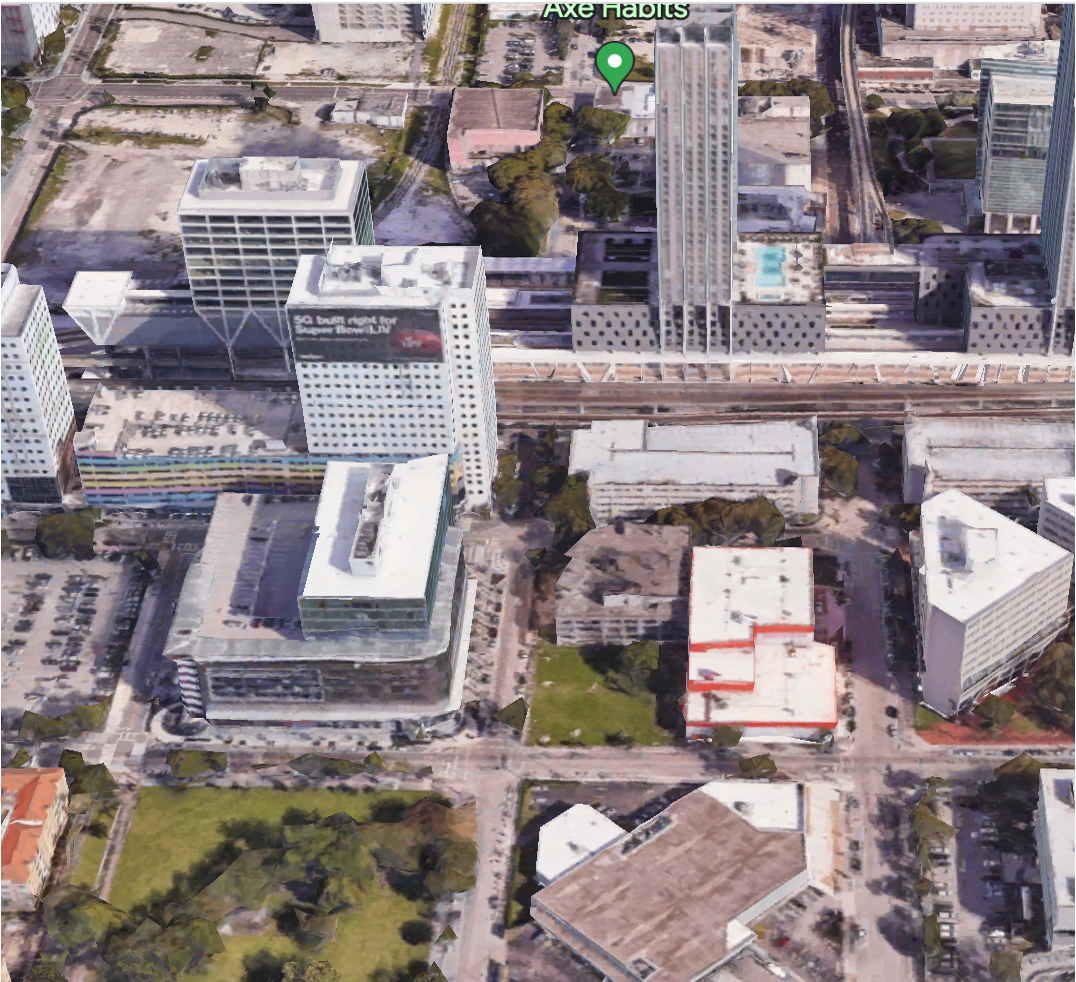

Land Development

Mixed-Use High Rise

Description: acquisition + entitlements for development

Size: 1.2 Acres

Acquisition Date: Feb 1, 2023

Total Cap: 39,500,000

Downtown Miami Land

Miami, FL

Multifamily, New Construction

Mixed-Use High Rise

Property Class: A+

Description: Value-add investment

Size: 306 Units

Acquisition Date: Feb 1, 2023

Total Cap: 369,750,000

HubMiami

Miami, FL

Commercial, Medical Offices

Net Leased

Property Class: B

Description: Small-cap recession resiliant investment

Size: 44,000 SF

Acquisition Date: Oct 1, 2022

Total Cap: 3,600,000

Medical Clinic – Ocala

Ocala, FL

Land Development

Mixed-Use

Description: Commercial property demolished & land-use change

Size: 2 Acres

Acquisition Date: Sep 1, 2022

Total Cap: 5,000,000

Ludlam Plaza Land

Hialeah, FL

Commercial, Medical Offices

Net Leased

Property Class: B

Description: Small-cap recession resiliant investment

Size: 25,000 SF

Acquisition Date: Sep 1, 2022

Total Cap: 2,000,000

Medical Clinic – West Hialeah

Hialeah, FL

Multifamily, New Construction

Mixed-Use

Property Class: B+

Description: Value-add investment

Size: 55 Units

Acquisition Date: Sep 1, 2022

Total Cap: 20,000,000

Ludlam Plaza

Hialeah, FL

Commercial, Medical Offices

Net Leased

Property Class: A

Description: Small-cap recession resiliant investment

Size: 12,000 SF

Acquisition Date: Sep 1, 2022

Total Cap: NA

Medical Clinic – East Hialeah

Hialeah, FL